As online tools make it easier to interact with worldwide clients, an increasing number of enterprises are selling internationally.In fact, according to a Stripe research, 70% of internet businesses already sell overseas.While reaching a worldwide audience is easier than ever, online firms face a new challenge:How can you address a worldwide audience’s different client preferences during the checkout process? Customers’ preferences for paying for goods or services online through payment methods vary greatly depending on where they live.

You could exclude entire countries from your potential market if you don’t create a meaningful, familiar payment experience.Despite the fact that the global payments landscape has become increasingly complex and fragmented, Stripe makes it simple for any type of business anywhere in the world to discover and accept popular payment methods with a single integration. This article assists you in evaluating and identifying payment methods that are well-suited to your business model and client preferences, as well as providing an in-depth look at the payment methods supported by Stripe.

The advantages of various payment methods

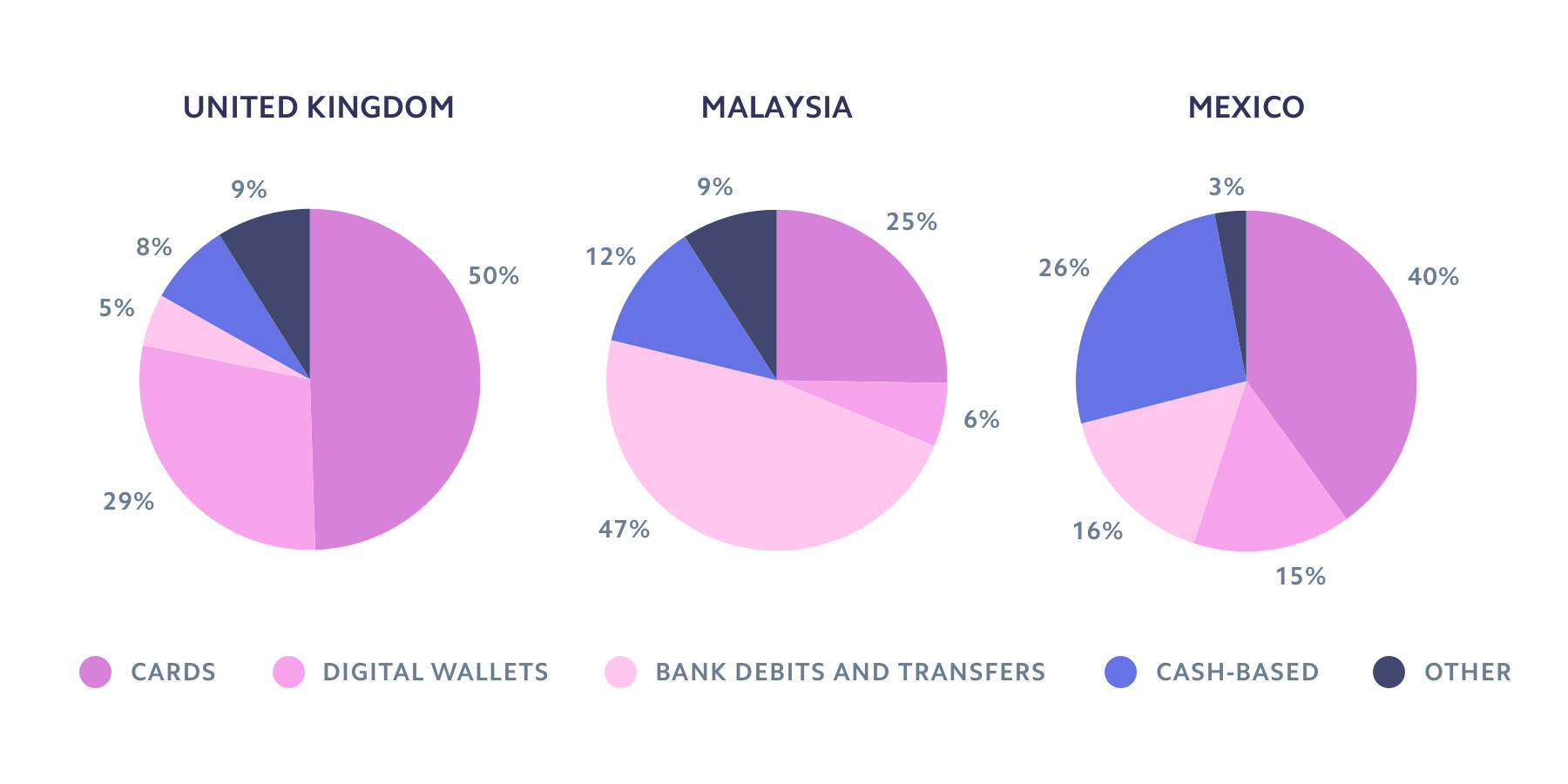

Payment methods have changed over the last decade to meet a variety of consumer and company needs.Markets with high card penetration, such as the United States and the United Kingdom, have seen a big move toward wallets such as Apple Pay and Google Pay, which provide more security and ease.Some markets, such as France and Japan, even have their own local card networks to assist firms in reaching out to additional card users.

Bank-based methods are significantly desired and trusted for online purchases in areas such as Germany and Malaysia, where card use is much lower.These markets’ banking networks often provide a faster and more secure checkout experience, allowing consumers to authorize a payment using their online banking credentials.Meanwhile, popular payment methods allow users to pay for online goods with cash utilizing vouchers in nations with a large unbanked population, such as Mexico and Indonesia.

Reach out to more clients throughout the world: As you grow into new locations, adopting local payment methods may become important in order to capture the entire market opportunity.In China, for example, wallets such as Alipay or WeChat Pay account for 54% of online transactions, while the local card network China Union Pay accounts for 20%.Without these payment methods, you risk losing out on the significant and expanding purchasing power of Chinese customers.

Increase conversion:

Up to 16% of shoppers abandon their shopping cart if their preferred payment method is unavailable.Providing clients with the correct mix of payment choices can significantly boost the likelihood that they will finish a purchase.

Reduce fraud and disputes:

Anticipate and manage the risks of accepting online payments by selecting payment options that correspond to your risk preferences.In general, the higher the level of consumer authentication, the less likely fraudulent and contested payments are.

Optimize your transaction costs:

Various payment options have different cost structures.Certain payment options may or may not be applicable depending on your business strategy and where your consumers are situated.

Top Payment Methods In International Trade In 2022

The following are the payment options available in Europe:

1) Visa and Mastercard Card Payments

Visa and Mastercard are both worldwide financial services firms that specialise in credit and debit card payments linked to bank accounts.With billions of users worldwide, they are a strong choice for retailers wishing to offer popular payment methods to their clients.The strongest geographies are the United Kingdom, Spain, and Poland. Italy, Germany, and Norway have the weakest geography.

2) Use PayPal

PayPal, which was founded in 1998, was the first financial technology company to allow clients to pay with an email address.When eBay bought the company in 2002, it shot to global renown.PayPal users open an account (eWallet) in which they can store funds and transfer them to other consumers and shops.

- The average number of active daily users on PayPal varies greatly based on geography.

- Germany, the United Kingdom, and France have the strongest geography.

- Finland, Turkey, and Czechia are the weakest geography.

3) iDeal

The iDeal platform is a Dutch payment system that does not require the use of credit or debit cards.

The iDeal platform sends you to your bank account during the online checkout so that you can make a straight transfer to the chosen recipient.More than 53% of Dutch customers prefer to pay with iDeal.The Netherlands are the primary geographical location.

4) Giropay

Giropay functions similarly to iDeal in that it allows for bank-to-bank transactions.Giropay, like iDeal, focuses on a single market: Germany.Giropay connects to approximately 1,500 German banks around the country, virtually ensuring that German consumers can conduct a direct bank transfer to another German customer.Giropay accounts for 51% of all online transactions in the country. Germany is the primary geography.

5) BNPL

Sofort, which was recently purchased by BNPL firm Klarna, has renamed as PayNow in the majority of its target territories.It is comparable to Giropay and iDeal, although it is more commonly utilised in a few European nations. Austria, Germany, Switzerland, and Belgium have the strongest geography.Poland, Italy, and Spain are the weakest geography.

6) Bancontact

The Bancontact payment system, which is popular in Belgium, uses a single authentication to complete payments.

Users are sent to a Bancontact window to authenticate before being redirected back to the original website for payment confirmation, like with the other payment methods on this list. Belgium is the primary geographical area

7) EPS

Customers of Austrian banks can use EPS, a bank-to-bank transfer payment method.Because 80 percent of Austrian retailers accept EPS payments, it’s worth considering if you conduct a lot of business in the nation.Austria is the primary geographical location.

8) Multibanco

Customers can use the Multibanco payment option to pay retailers using their bank account information or at ATMs.

The service is most popular in Portugal, where it is supported by all of the country’s banks.

Portugal is the primary geographical area.

9) SEPA Direct Debit

SEPA is an abbreviation for the Single Euro Payments Area.After obtaining a client mandate, the merchant initiates the payment or series of payments using this payment mechanism.The benefit of using SEPA Direct Debit is that it provides a seamless experience for both the customer and the merchant, especially when used for regular payments.

10) Klarna

BNPL (Buy Now Pay Later) payment alternatives are becoming more popular.Klarna, with a current valuation of $45.5 billion USD, is by far the most well-known example.BNPL payment systems are anticipated to face regulatory difficulties, which could limit their service expansion.For the time being, though, their popularity cannot be denied. From the standpoint of the consumer, BNPL systems operate by charging instalments until the full amount is paid.

FAQ

Do you get foreign payments?

As you can see, not all payment options accept international transactions.If you will be receiving such payments, you must choose a payment system that accepts overseas transfers.

Do you have to support numerous currencies?

Multi-currency payment options are often more expensive than single-currency payment methods.If you receive payments from a variety of consumers in their currencies, you might consider adopting a multi-currency platform.

What payment methods are popular in your area?

Your company must meet your clients where they live.Allowing customers to pay you using methods they choose or are comfortable with is part of this.

Do you value the client experience?

Many clients appreciate the variety and convenience that numerous payment choices provide.

If customer satisfaction is a top priority for business, consider incorporating different payment methods.

Are transaction fees an issue?

While the issues stated above are serious, your company must nonetheless make a profit.Keep an eye on applicable fees and how they may affect your bottom line.

Is the prevention of fraud a major priority?

Consider utilising a payment solution that helps you better control those risks with solid chargeback and fraud protection if you need to provide improved payment risk management.

Is there any security with the payment method?

Finally, security is as crucial as fraud prevention.Certain payment methods, as we’ve seen with Apple Pay, are well-known for their rigorous security features.They instil trust in your e-commerce store and might serve as an incentive for customers to begin and complete purchases.

Check Also : Best Strategies to Pay PayPal Credit Card Payment