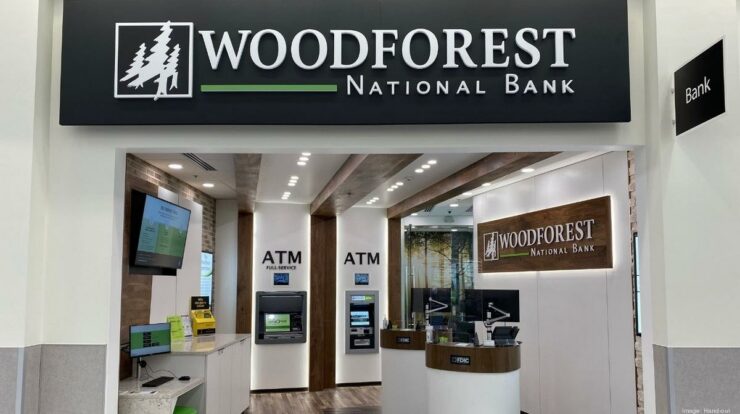

Since 1980, Woodforest National Bank has proudly offered outstanding customer service, making it one of the strongest community banks in the nation for over 30 years. Woodforest National Bank offers consumer and business products and services at more than 740 locations across 17 states. Our private employee stock ownership plan is the biggest shareholder at the National Woodforest Bank. The staff at Woodforest National Bank puts a lot of effort into understanding each client’s financial needs and delivering exceptional banking services in the spirit of “true ownership.” They also donate money and countless hours of volunteer labor to support local organizations and civic events. They “give back” to the various banking communities in which we operate in addition to living and working there.

One of the largest “small” banks you will ever come across is the National Woodforest Bank, which has 788 branches spread across 17 states. It provides one money market account (MMA), certificates of deposit (CDs), individual retirement accounts (IRAs), and a wide variety of checking and savings accounts. The bank consistently offers low minimum initial deposit requirements along with monthly service costs.

Woodforest: What Is It?

With a reputation for adopting a community-first philosophy, the National Woodforest Bank actively participates in charitable endeavors and provides funding to local initiatives.

- Variety of Services: The bank provides a range of financial services, such as credit cards, business banking, mortgages, loans, and standard banking products like savings and checking accounts.

- Technologically Ahead: The Woodforest Bank login places a high priority on technological innovation, offering online and mobile banking services to increase client accessibility and convenience.

- Focus on Financial Education: It provides resources to help customers make informed financial decisions and is committed to advancing financial literacy.

- Business Banking Solutions: Tailored services for businesses of all sizes, including cash management and other business-focused financial products.

- Investment Services: Woodforest Bank offers investment services to assist clients in growing their funds and creating long-term plans.

Services Provided by the National Woodforest Bank

The fifteen services that the National Woodforest Bank offers are as follows:

- Financial Services Conventional: Woodforest offers traditional banking services like checking and savings accounts.

- Online and mobile banking: Users can easily manage their accounts with the help of easily navigable and user-friendly online and mobile systems.

- Loans and mortgages: To better support its diverse customer base, Woodforest provides a variety of loan and mortgage options.

- Bank Transfer: The business offers credit card services with fair interest rates and incentive programs.

- Finance for Commercial Items: solutions created especially for companies, ranging from small startups to large conglomerates.

- Services for Financial Advisors: Woodforest Bank helps customers make wise investment decisions, which fosters financial growth.

- Services in the Insurance Industry: comprehensive insurance policies that ensure protection against unforeseen circumstances.

- Making Retirement Plans: specific retirement planning services to help clients safeguard their future finances.

- ATM Establishment: Because ATMs are widely dispersed, customers can easily access their cash.

- Understanding of Finances: In addition to offering clients educational materials, Woodforest is committed to advancing financial literacy.

- Customer Support: A committed customer support team ensures that any banking questions will be answered quickly.

- Defense Against Deception: advanced security measures to prevent account fraud on consumers.

- Quick Deposit: Convenient mobile deposit options make check deposits simple and quick.

- Administration of Finance: Woodforest Bank provides business owners with strategies for efficient money management.

- Participation in the Community: The organization actively engages with and supports the local community through several programs.

Which online games does Woodforest National Bank offer?

The National Woodforest Bank has embraced the shift in the banking industry toward a greater reliance on online banking. This enables you to plan one-time and recurring transfers between accounts, view transaction histories, and check the balances of all your bank accounts. Customers may also be required to purchase checks or new debit cards, request that payments be stopped, and set up automated security and account notifications, among other administrative tasks.

Are you looking for an easy way to handle your money?

All of your online bank account’s e-statements are available for download into Quickbooks or Intuit® Quicken. Both Mac and Windows can use this service. The Woodforest login mobile app has an average rating of roughly 3.5 stars on both the Apple and Android platforms, which is somewhat higher than even the online banking website. You can send and receive money via Woodforest’s integration with the Western Union® Online Money Transfer service, in addition to using the app and the branch/ATM location. You can even “shut off” your debit card remotely if it is lost.

National Woodforest Bank Features

The following are the National Woodforest Bank’s twenty features:

- A Method Based in the Community: Woodforest encourages social responsibility through its commitment to community involvement.

- Customized Support: Modifying offerings to meet particular needs to offer a personalized banking experience.

- Fair Prices: Woodforest strives to offer fair rates for loans, mortgages, and savings accounts.

- Innovative technology: adopting technological advancements to provide cutting-edge banking solutions.

- Accessible: An extensive ATM network and online services improve client accessibility.

- Financial Well-Being Programs: In addition to banking, the Woodforest bank login offers programs that promote responsible money handling.

- An Extensive Selection of Goods: A wide range of financial options to meet different needs and preferences.

- Modest Price Schedule: Woodforest prides itself on having no hidden fees and an honest pricing schedule.

- Secured Banking Services: Establishing robust cybersecurity protocols with the main objective of safeguarding customer accounts.

- Teaching Resources: Offering financial education resources to enable users to make informed decisions.

- Basic Management of Accounts: Easy-to-use web and mobile interfaces for seamless account management.

- Quick approval of loans: expedited processes to approve loans faster, assisting borrowers in immediate financial need.

- Reward Programs: Offering rewards and incentives to credit card users to foster loyalty.

- Personal support: Despite advancements in technology, Woodforest Bank still provides in-person services for those who prefer traditional banking.

- Flexible Business Solutions: Solutions created especially to support business development and expansion for organizations of all sizes.

- Being diligent: Woodforest actively contributes to and volunteers for social issues.

- Understanding of Retirement Planning: Professional guidance on creating plans for a happy and safe retirement.

- Responsive customer support: a commitment to offering clients prompt, effective service that ensures their satisfaction.

- Mobile Deposit Convenience: Simplifying deposit options for mobile devices will simplify banking.

- Policy All-Inclusive: Offering a range of insurance choices to guarantee complete financial security.

How can I open a National Woodforest Bank account?

Although you can open a new account with many banks online, in person, or over the phone, Woodforest requires you to speak with a representative. This suggests that you have to give a call or visit a branch in person to finish an account application. Regardless of the approach you choose, you will need to have the following essential documentation available to verify your identity:

- Social Security number

- Date of birth

- Driving privileges

- If necessary, cash is needed to meet the opening minimum.

How do I receive my money?

For the simplest way to check your account balance, use your National Woodforest Bank debit card. It can be scanned at any participating fee-free ATM to obtain cash, or it can be used as a direct payment method, akin to a credit card. The bank’s collaborations with Apple, Samsung, and Android Pay allow it to link your card and digital wallet together. Similar to other money transfer services like Venmo, you can use Western Union® to transfer money from a Woodforest bank login account to the account of a friend or anybody else. This is incorporated right into the Woodforest mobile app to simplify the process as a whole. If you would prefer to deposit money rather than withdraw it, the bank allows mobile check deposits through the app.

Pros and Cons

Advantages

- Engagement with the community: Woodforest Bank Login’s dedication to neighborhood events fosters positive social effects.

- A strategy that prioritizes the needs of the customer: The organization gives priority to individualized support that addresses each person’s needs.

- Innovative technology: acknowledging that technological advancements can enhance banking experiences.

- Fee schedules with no restrictions: A commitment to keeping finances transparent and avoiding hidden expenses.

- A wide variety of goods: offering a large range of financial products to meet various needs.

- Safety Protocols: robust cybersecurity protections against potential account hacks.

- Finance Education: Utilizing financial literacy initiatives to provide information to clients.

- Quick Loan Approval: Streamlined processes to deliver financial assistance and loan approvals more quickly.

- Business Settlements: tailoring services to companies to promote growth and development.

- Developing Retirement Strategies: Expert guidance and support for a comfortable and secure retirement transition.

Cons

- Reduced physical presence: The organization may not have as many physical branches in other locations.

- Dependency on Electronics: It could be challenging for customers who prefer in-person assistance to rely solely on technology.

- Regional Restraints: Some services might only be offered in specific areas.

- Standards for Approval of Credit: It could be challenging for some applicants to fulfill the stringent requirements for credit approval.

- Limited Entry to International Services: For international transactions, there might be fewer services offered than at larger banks.

- Limited ATM Reimbursement: Some competitors’ ATM refund policies are probably more generous than this one.

- Account Maintenance Fees: Even though the costs are clearly stated, some clients may believe that they are excessive.

- Few Investment Possibilities: The range of investment options may be more constrained than in the case of specialized investing firms.

- Limited Services Offered at Certain Branches: Customers who prefer in-person interactions may suffer if in-person services are reduced.

- Limited-Earning Plans: The credit card rewards program may not be as attractive as competitors.

What is the address of the National Woodforest Bank?

Woodforest National Bank has branches in 17 states: Alabama, Florida, Georgia, Illinois, Indiana, Kentucky, Louisiana, Maryland, Mississippi, North Carolina, New York, Ohio, Pennsylvania, South Carolina, Texas, Virginia, and West Virginia. In total, there are more than 788 sites. Furthermore, Woodforest Bank provides live chat assistance on its website and a phone line that is available around the clock for questions about any account information.

Greetings, Woodforest National Bank, our newest member!

Woodforest is a community bank founded on the demands of its clients. They are recognizable because they are found in a few Walmart Supercenters. Seneca County is home to Woodforest’s Branch Manager, Jonathan Brown, who was raised there. He spent more than ten years working in retail before switching to the financial industry. He saw an opportunity to broaden his skill set, advance his professional career, and engage more with the community he grew up in when Woodforest offered him the branch manager position.

Woodforest Bank has been providing exceptional customer service and standing as one of the strongest community banks in the country for more than 40 years. The first Walmart store opened its doors in 1980 in Houston, Texas; the first Walmart store opened its doors in Conroe, Texas, in 1996; and in 2005, the first stores outside of Texas opened. With fair, obliging, and competent staff, Woodforest National Bank is dedicated to gaining the trust of its clients by providing the best possible customer service along with competitive products and services. They put a lot of effort into fostering relationships, looking for ways to better serve their communities, and being aware of each client’s financial requirements. From checking and savings accounts to business and consumer loans, financial literacy programs, and credit lines, they provide a wide range of banking and lending choices for both consumers and businesses.

How can I increase my savings with a Woodforest National Bank account?

As a general rule, interest rates get worse the larger the bank, and this also applies to Woodforest. Unfortunately, that’s also the case with the best checking and savings accounts, as well as the longest-term CDs. It is therefore difficult for a Woodforest bank account to outearn some of its competitors. Although Woodforest has locations throughout the states, other banks offer higher APYs; Woodforest’s monthly service charge structure is significantly lower than others. Thus, even if you miss out on some intriguing growth opportunities with this bank, you will likely end up saving money on pointless fees.

In summary

A standout player in the vast field of financial institutions, Woodforest offers a variety of financial needs by combining state-of-the-art technology, personalized service, and community involvement. As we conclude our analysis of the benefits, drawbacks, and frequently asked questions of Woodforest, we invite you to join the conversation. As we near the end of delving into the subtleties of Woodforest, we would love to hear your thoughts. To participate in the conversation about banking, financial wellness, and how companies like Woodforest Bank affect our financial future, leave a comment below. Your contributions enrich the dialogue and turn it into a helpful resource for anyone navigating the constantly changing landscape of personal finance.

FAQs

1. Is woodforest limited to certain states?

The woodforest is more dense in some places, even though it is found in multiple states.

2. What is the reimbursement policy for ATMs?

Woodforest reimburses ATM fees for certain accounts; however, there may be limitations to this policy.

3. Is it possible to create an online account?

Woodforest does offer the option to create an account online for added convenience.

4. Do financial services have an international reach?

Even though Woodforest Bank provides some international services, its selection may not be as wide as that of bigger banks.

5. What is the process for contacting customer service?

Contacting customer service can be done via phone, email, or in-person meetings.

6. Does Woodforest offer resources for financial literacy?

Woodforest is committed to advancing financial literacy and provides resources for client education.

7. What categories of financial services does Woodforest provide?

Woodforest provides a variety of investing options to help its clients increase their wealth.

8. Is there a Woodforest banking mobile app available?

Yes, Woodforest provides a mobile app for convenient banking on the go.

9. What sets Woodforest Bank apart from other banks?

Woodforest distinguishes itself with its proprietary technologies, personalized service, and community-oriented mindset.

10. Do you have any special deals available to new customers?

For new customers, Woodforest can offer exclusive deals or discounted rates.